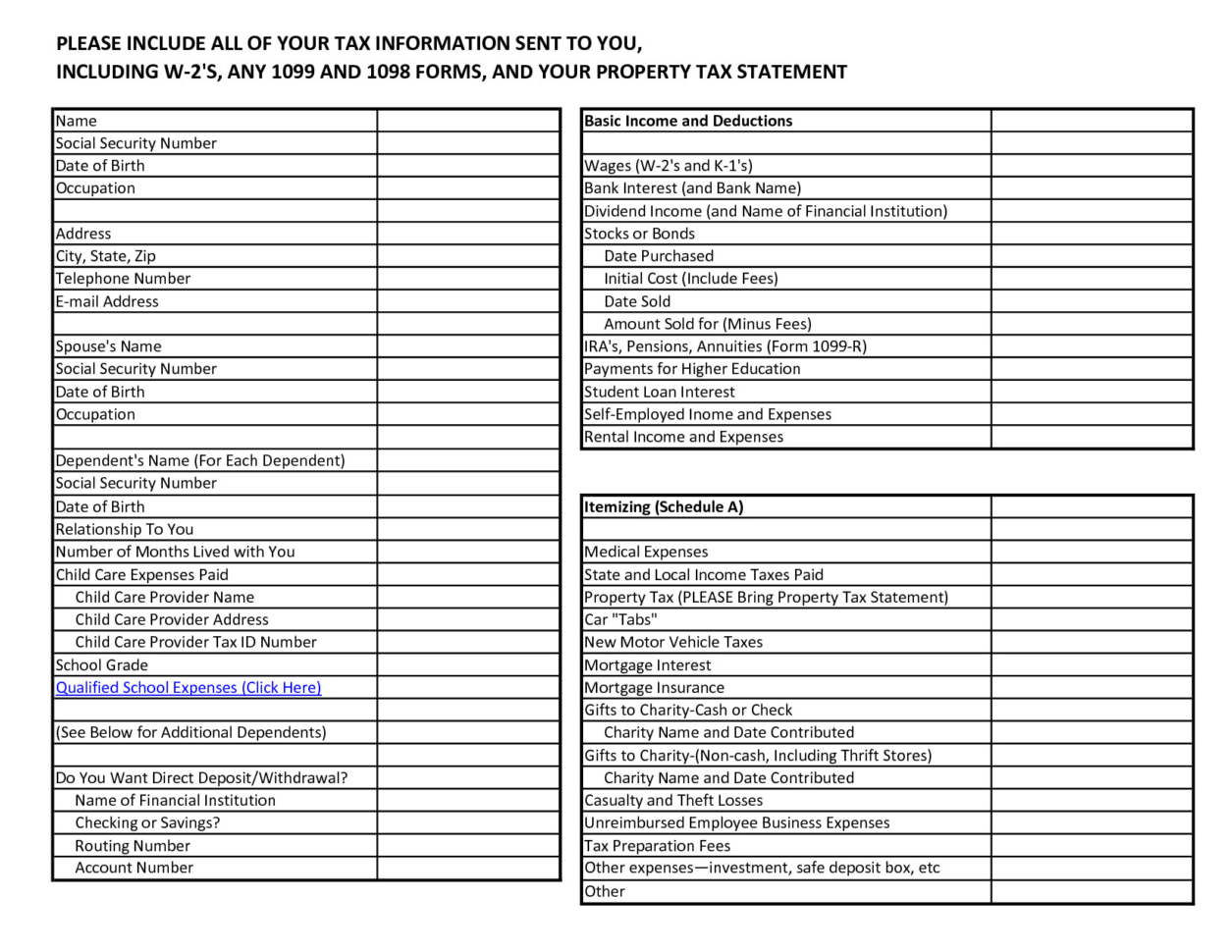

Business Expenses Deduction 2025 - 1099 Tax Deductions List 2025 Lesly, Eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year the asset is first used or installed ready for use. Small businesses with an aggregated annual turnover of less than $50 million will be allowed an additional 20% tax deduction to support their digital operations and digitise their. What changes did the tax cuts and jobs act make to deductible business expenses?

1099 Tax Deductions List 2025 Lesly, Eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year the asset is first used or installed ready for use.

Business Vehicle Deduction 2025 Muire Tiphani, Read this small business expense checklist to learn what you can write off.

Business Meals Deduction 2025 Irs Pia Leeann, If you are claiming your working from home expenses, you can’t claim a deduction for expenses which have already been reimbursed by your employer.

Business Expenses Deduction 2025. The asset must be first used or installed ready for use for a taxable. Understand which business expenses can be claimed as tax deductions.

Qualified Business Deduction 2025 2025, Here's how those break out by filing status:

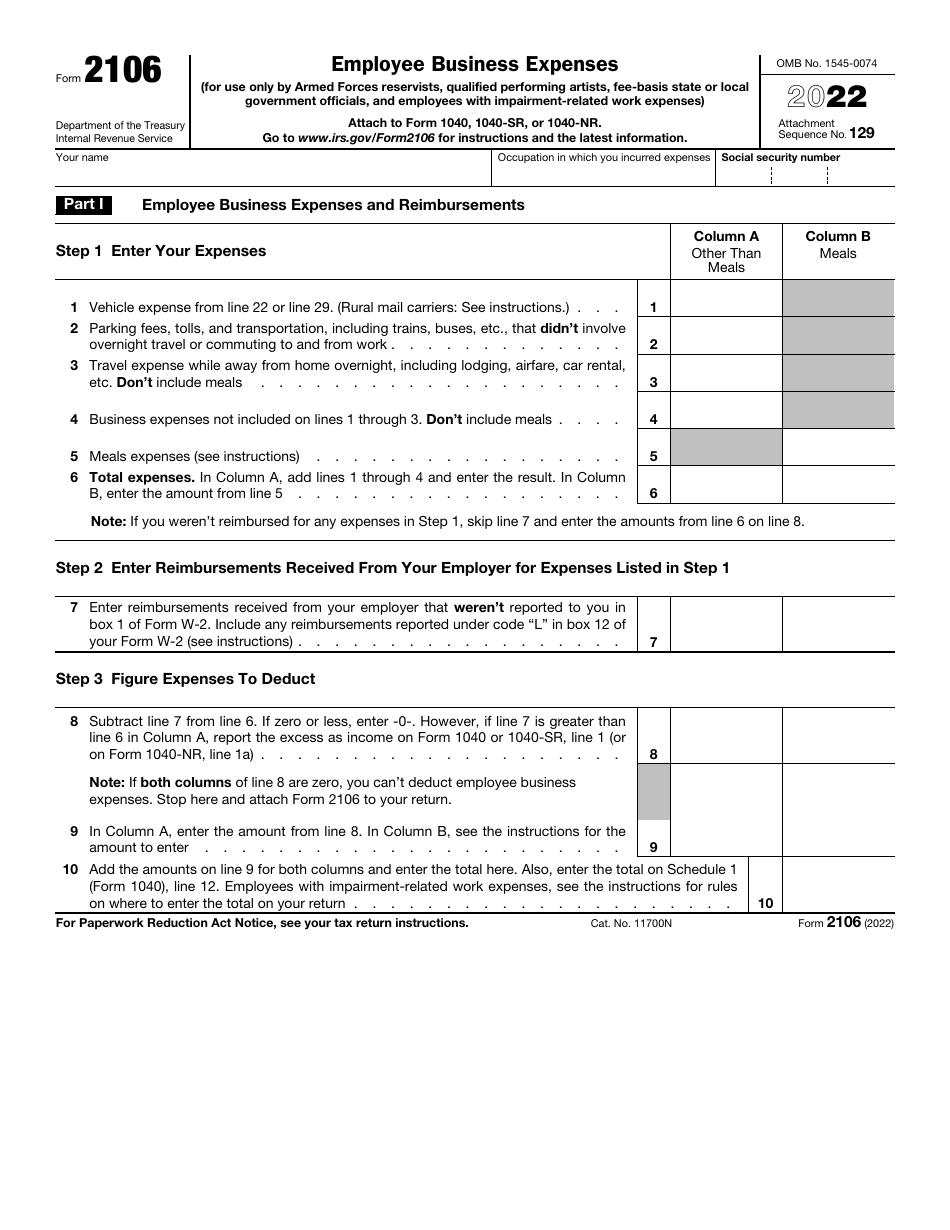

Employee Business Expenses Deduction 2025 Terza, What changes did the tax cuts and jobs act make to deductible business expenses?

Can You Deduct Business Expenses In 2025 Lorne Rebecka, The expense must be for his business, not for private use.

Employee Business Expenses Deduction 2025 Terza, Find out what expenses you can claim, when to claim, and the records you need to keep.

/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

Warped Tour 2025 Compilation. Warped tour announces its return in…

Employee Business Expenses Deduction 2025 Terza, Here's how those break out by filing status:

NonAccountable Plan AwesomeFinTech Blog, You also need to apportion for private and business use, understand the.